Financial performance explained

Expenditure

| 2011/12 | 2010/11 | 2009/10 | |

| Staff costs | 72.1% | 72.4% | 72.5% |

| Premises and related expenses | 11.4% | 11.4% | 11.3% |

| Other expenses | 12.0% | 10.9% | 11.6% |

| Depreciation | 4.5% | 5.3% | 4.6% |

| 100% | 100% | 100% |

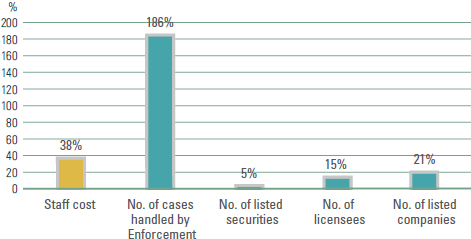

We managed to keep the costs of our ongoing regulatory activity at $901.6 million, $153.6 million below our original budget of $1,055.2 million. Staff is our most valuable asset and accounted for over 70% of our total expenditures. Over the past five years, our staff costs increased just 38% although the number of cases handled by enforcement, listed securities, licensees and listed companies rose 186%, 5%, 15% and 21% respectively.

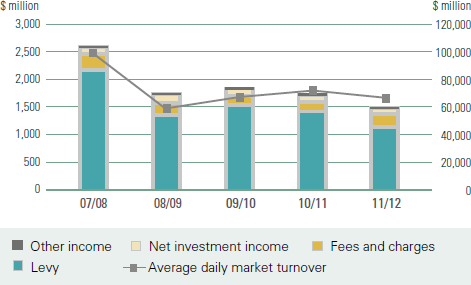

Funding

We are funded mainly by transaction levies and fees from market participants. The reduction of the levy on 1 October 2010 brought the levy down to the current rate of 0.003% of securities transactions, significantly lower than the rate of 0.0125% when the mechanism was first set up. Our fees are charged on the principle that users pay. Although our fee income is below the attributable costs of the fees, we have not raised our fees and charges since 1994/95.

Total revenue for the year was $1.45 billion, down 13.7% from $1.68 billion a year ago. Owing to the decline in the securities market turnover and reduction of the levy rate, our levy income dropped by 20.4% to $1.09 billion from $1.37 billion a year ago.

| 2011/12 | 2010/11 | 2009/10 | |

| Levies | 75.6% | 81.6% | 83.3% |

| Fees and charges | 15.9% | 10.2% | 8.6% |

| Net Investment Income | 8.0% | 7.6% | 7.6% |

| Others | 0.5% | 0.6% | 0.5% |

| 100% | 100% | 100% |

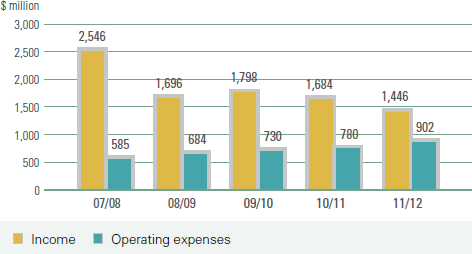

The ratio of average expenses to income for the past five years was 40.1% and the average increase on expenses was 10.8%, and on income was 9.4%.

| 11/12 | 10/11 | 09/10 | 08/09 | 07/08 | 5 year average |

|

| Expenses to income ratio | 62.4% | 46.3% | 40.6% | 40.3% | 23.0% | 40.1% |

Surplus for the year amounted to $544 million, down from $903 million last year. At 31 March 2012, our reserves had accumulated to $7.5 billion, which we managed in strict accordance with investment guidelines approved by the Financial Secretary.