This section is intended to provide a brief overview of our disciplinary process. Under Part IX of the Securities and Futures Ordinance (SFO), the SFC is given power to discipline those that it licenses or registers, comprising firms and those who perform functions for them which require a licence or registration including those involved in their management1 (together referred to as “regulated persons”). If the SFC finds that a regulated person’s conduct suggests it is guilty of misconduct or not fit and proper, the SFC may impose sanctions selected from a range set out in the SFO. This section explains how we go about this process.

1The SFC also disciplines under the old law in relation to conduct which occurred before the commencement of the SFO on 1 April 2003 by virtue of certain transitional provisions in Schedule 10 of the SFO.

This section does not concern other actions the SFC may take such as civil proceedings before the High Court, criminal proceedings before the Magistrates’ Court or proceedings before the Market Misconduct Tribunal.

The SFC’s disciplinary process is explained in the sub-sections below:

Why does the SFC discipline?

Under the SFO, one of the SFC’s functions is to protect the interests of investors and to maintain market integrity. One of the ways we do this is by enforcing the law through imposing disciplinary sanctions on regulated persons. Through discipline, the SFC ensures firm and appropriate action is taken against those who harm investorsor damage market integrity, regardless of their position and status. The threat of sanctions being imposed by the SFC serves to deter non-compliance with regulatory requirements.

It is of paramount importance to us that all regulated persons are treated fairly in the disciplinary process. When making disciplinary decisions, the SFC will have regard to its previous decisions while taking into account the specific circumstances of each case. However, the Securities and Futures Appeals Tribunal (SFAT)2 has ruled that the SFC may disregard previous decisions where changed circumstances warrant it. The SFC will adjust its penalties from time to time in light of various considerations it deems relevant to the discharge of its statutory duties and to changing market circumstances, particularly market participants' behaviour. The SFC aims at all times to impose sanctions which are proportionate to the gravity of the improper conduct.

2 See sub-section "Disciplinary process" for a discussion of the role of the SFAT.

Who is subject to SFC disciplinary action?

As noted above the SFC has power to take disciplinary action against regulated persons only. They include: licensed corporations or registered institutions; representatives and responsible officers of licensed corporations; executive officers, relevant individuals and former relevant individuals of registered institutions; and those who are not licensed or otherwise given a regulatory approval but are involved in the management of a licensed corporation or registered institution (including, for a licensed corporation, its directors and Managers-In-Charge of Core Functions (MICs))3.

3 Based on the SFC’s Circular to Licensed Corporations Regarding Measures for Augmenting the Accountability of Senior Management dated 16 December 2016, an MIC refers to an individual appointed by a licensed corporation to be principally responsible, either alone or with others, for managing any of the following functions of the corporation: (i) Overall Management Oversight; (ii) Key Business Line; (iii) Operational Control and Review; (iv) Risk Management; (v) Finance and Accounting; (vi) Information Technology; (vii) Compliance; and (viii) Anti-Money Laundering and Counter-Terrorist Financing.

Criteria for determining whether to take disciplinary action and the level of sanctions

The SFC will consider all the circumstances of a case, including:

- The nature and seriousness of the conduct

- impact of the conduct on market integrity

- costs imposed on or losses caused to clients, market users or the investing public

- nature of the conduct (eg, whether it is intentional, reckless or negligent; whether prior advice was sought from advisors or supervisors)

- duration and frequency of the conduct

- whether the conduct is wide spread in the industry

- whether the conduct was engaged in by the firm or individual alone or as a group and the role in that group

- whether there is a breach of fiduciary duty

- (for firms) revelation of serious or systematic management system or internal control failures

- whether the SFC has issued any guidance concerning the conduct

- The amount of profits accrued or loss avoided

- Other circumstances of the firm or individual

- manner of reporting the conduct by the firm or individual

- degree of cooperation with the SFC and other authorities

- remedial steps taken since the identification of relevant conduct

- previous disciplinary record

- (for individuals) experience and position

- Other relevant factors

- SFC's action in previous similar cases (Note: Usually similar cases would be treated consistently. However, if the misconduct has become prevalent or widespread in the market, the SFC may impose a heavier sanction than in the past.)

- punishment or regulatory action by other authorities

The criteria listed above are not exhaustive.

Disciplinary measures available to the SFC

The SFC is empowered to impose one or more of the following sanctions:

- revocation or partial revocation of licence or registration

- suspension or partial suspension of licence or registration

- revocation of approval to be a responsible officer

- suspension of approval to be a responsible officer

- prohibition of application for licence or registration

- prohibition of application to become a responsible officer, executive officer or relevant individual

- fine (up to the maximum of $10 million or three times of the profit gained or loss avoided, whichever is the higher)

- private or public reprimand

All the SFC's sanctions, other than a private reprimand, will be published by means of a press release. All press releases on SFC enforcement actions, including disciplinary actions, are available under "News and announcements" - "News" -"Enforcement news".

To better understand our considerations when imposing a fine, please refer to the SFC Disciplinary Fining Guidelines published in February 2003, which can be found under "Rules & standards" - "Codes & Guidelines" – "Guidelines".

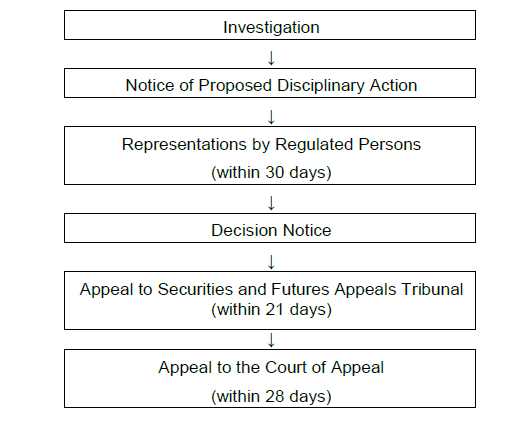

Disciplinary process

Investigation

The SFC investigates acts that suggest misconduct or that call into question the fitness and properness of a regulated person. The SFC may initiate an investigation on the basis of information from any source, including the public, other regulators or law enforcement agencies in Hong Kong, such as the Hong Kong Monetary Authority, the Hong Kong Police, Hong Kong Exchanges and Clearing Limited (HKEX), foreign regulators and internal referrals. Internal referrals may arise from our monitoring of day-to-day trading in the stock and derivatives markets, from our inspections of intermediaries or from investigations into other matters, such as civil market misconduct or criminal offences. Following the investigation, we will consider whether or not there is sufficient evidence to commence disciplinary proceedings.

Our disciplinary investigations should not be confused with those of other bodies, such as the Hong Kong Police or the Independent Commission Against Corruption, who investigate suspected criminal behaviour, or other bodies with the power to discipline, such as HKEX.

Notice of proposed disciplinary action (NPDA)

An NPDA is sent to a regulated person if the SFC decides to start disciplinary proceedings. The NPDA sets out our preliminary views on the misconduct or conduct that calls into question the fitness and properness of the regulated person. It also states the sanctions we consider appropriate to impose on the basis of the facts as we understand them at the time.

Representations by regulated persons

In the NPDA, the SFC invites the regulated person to explain the matter and why the proposed sanctions are not appropriate. Representations should be made in writing to the person who signed the NPDA. We expect representations on the facts and proposed sanctions to be made at the same time.

An opportunity to be heard

Before exercising any power to discipline, the SFC must first give the regulated person a reasonable opportunity to be heard by allowing the regulated person to make representations explaining the matter and commenting on the appropriateness of the proposed sanctions. Under normal circumstances, the regulated person is given 30 days to make representations. However, we will consider reasonable requests for further extensions (eg, to consider complex evidence).

If a response is not provided before the deadline stated in the NPDA, the SFC will make a final decision on the sanctions based on the evidence before it and it is likely that the SFC will impose the sanctions proposed in the NPDA. The SFC will then send a decision notice to the regulated person.

Legal representation

A regulated person may wish to get legal advice, which may include instructing their lawyer to make representations to the SFC on their behalf.

Request for evidence when making representations to the SFC

When the SFC issues an NPDA to the regulated person setting out the proposed sanctions, the SFC will also provide the regulated person with a list of documents that are relevant to the facts and matters set out in the NPDA. The regulated person may ask for a copy of documents on the list from the SFC.

Meeting the SFC

Disciplinary proceedings are normally determined on the basis of written submissions. However, a regulated person may ask for a meeting with the SFC to make oral submissions. A regulated person who wants to have a meeting with the SFC must apply to the SFC in writing explaining why he thinks a meeting is necessary. Such a meeting will be held if we consider fairness in the circumstances requires it.

In the course of disciplinary proceedings, if fairness in the circumstances demands, we may invite a regulated person to attend a meeting to clarify certain issues even without an application from that person. We may notify a regulated person of our decision to hold a meeting in these circumstances in the NPDA or after receiving written submissions.

Decision notice

The SFC will review all information submitted by the regulated person together with all the evidence it already possesses. We will then send a decision notice in writing to the regulated person detailing our decision. The decision notice will set out:

- the reasons for the decision;

- the time at which the decision is to take effect;

- the duration and terms of any revocation, suspension or prohibition to be imposed;

- the terms of any reprimand under the decision; and

- the amount of any fine that may be imposed as well as the date by which it must be paid.

The decision notice will also include information on the regulated person's right to appeal to the SFAT against the decision.

Resolving disciplinary proceedings by agreement

A regulated person may make a resolution proposal to the SFC. We have power to resolve disciplinary proceedings by agreement when we consider it appropriate to do so in the interest of the investing public or in the public interest. Whether we will resolve a case by agreement depends on the facts and circumstances of individual cases. We will consider every resolution proposal very carefully, and will agree to enter into resolution negotiations if we consider it appropriate and in the interest of the investing public or in the public interest to do so. Unless the regulated person and the SFC agree otherwise, all discussions about resolution proposals will be treated as "without prejudice", meaning that neither the SFC nor the regulated person may refer to those discussions in the disciplinary proceedings or subsequent legal proceedings.

Cooperation with the SFC

In deciding on the final sanctions, the SFC will consider whether the regulated person cooperates with the SFC. In appropriate circumstances, the sanctions may be reduced depending, amongst other things, on the timeliness, nature and degree of the cooperation. For more information on our approach to cooperation in disciplinary matters, please refer to the Guidance Note on Cooperation with the SFC published in December 2017, which can be found in the "Rules & standards" - "Codes & Guidelines" – "Guidelines" section of the SFC website.

Appeal to the SFAT

The decision of the SFC is subject to appeal to the SFAT, which is an independent appellate body chaired by a High Court judge. A regulated person, if aggrieved by the decision of the SFC, may appeal the decision by submitting a notice in writing to the SFAT within 21 days after a decision notice is served or given. The appeal period may be extended by applying to the SFAT and demonstrating good cause.

The notice to the SFAT must set out clearly the grounds for the appeal and should be delivered to the Secretary to the SFAT at:

The Securities and Futures Appeals Tribunal

5th Floor, High Block

Queensway Government Offices

66 Queensway

Hong Kong

(Tel: 2867 4967)

(Fax: 2507 2900)

Website:www.sfat.gov.hk

Effective date of a decision

If the regulated person does not appeal the SFC’s decision within 21 days, the decision will take effect at the time when the period expires.

If, within the 21-day appeal period, the regulated person informs the SFC, whether in writing or orally, that they will not appeal the decision, the decision will take effect at the time the SFC receives the notification.

If, within the 21-day appeal period, the regulated person appeals, the decision will not take effect until the SFAT makes a final decision. However, if the regulated person withdraws its appeal, the SFC’s decision will take immediate effect.

Appeal to the Court of Appeal

If the regulated person is dissatisfied with the SFAT’s decision, an appeal can be made to the Court of Appeal within 28 days from the date on which the SFAT makes a final decision. The regulated person may appeal only on a point of law and not on whether the SFAT's decision was the right one to make or if the SFAT misinterpreted the facts.

Paying a fine

If the regulated person is ordered to pay a fine, the fine must be paid to the SFC by the deadline specified in the decision notice, by cheque made payable to the "Securities and Futures Commission" and sent to:

The Securities and Futures Commission

(Attn: Director of Finance)

54/F, One Island East

18 Westlands Road, Quarry Bay

Hong Kong

Please quote the SFC’s case reference which is quoted on the SFC correspondence relating to the matter (eg, 508/EN/123).

Summary only, not legal advice

This is a summary for reference only. It is not legal advice. Regulated persons should seek their own legal advice.

Last update: 21 Jul 2023