The SFC has been at the forefront of local and global efforts to support the development of green and sustainable finance and the transition to a greener economy.

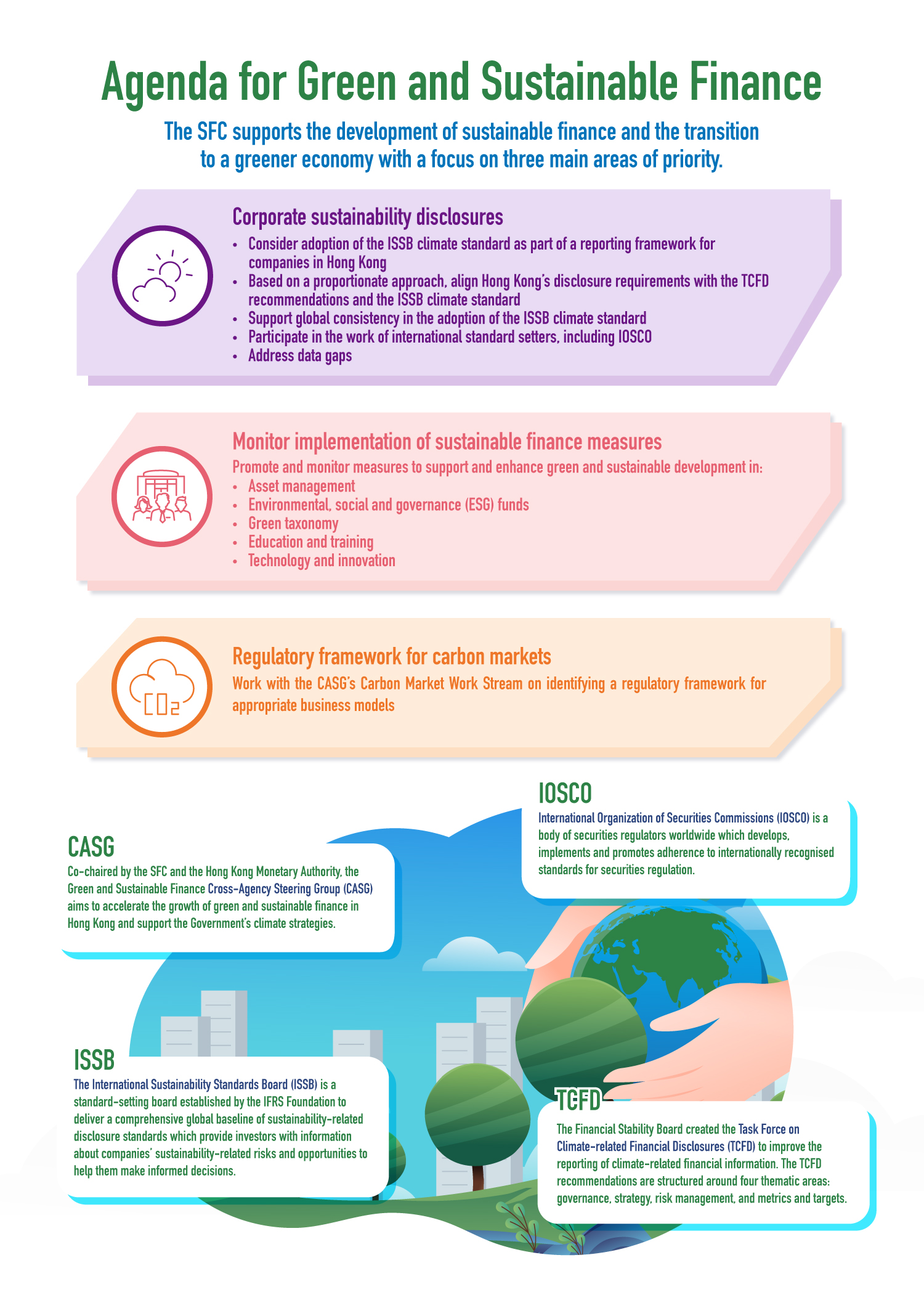

In August 2022, the SFC published its Agenda for Green and Sustainable Finance to set out further steps to support Hong Kong as a regional green finance centre, with a focus on corporate disclosures, asset management and environmental, social and governance (ESG) funds, and carbon markets.

In April 2023, the SFC announced its commitment to achieve carbon neutrality before 2050, in line with the Government's strategy set out in Hong Kong's Climate Action Plan 2050. The SFC also announced an interim target to reduce 50% of its total carbon emissions by 2030.

In July 2023, the SFC welcomed the endorsement by the International Organization of Securities Commissions of the IFRS Sustainability Disclosure Standards published by the International Sustainability Standards Board (ISSB). As set out in the HKSAR Government's vision statement on developing a sustainability disclosure ecosystem in Hong Kong, the SFC co-chairs with the Financial Services and the Treasury Bureau a dedicated working group that is developing a roadmap on the appropriate adoption of the ISSB Standards.

In November 2023, the SFC held its inaugural Forum on Sustainability Disclosures to gather market views on developing a sustainability disclosure ecosystem for Hong Kong, and to build industry preparedness and awareness of sustainability reporting against international standards. More than 200 leaders from the financial industry, listed companies and industry associations, as well as policymakers from Hong Kong, the Mainland and the Asia-Pacific region attended the forum.

Press on the icons and names of organisations below to learn about the SFC’s work in this area.

Last update: 10 Apr 2024