I. FAQs on aggregated orders

Q1 :

For monthly stock saving plans, we as an RRI will aggregate the investment amount of the customers and then allot the shares to them after purchase. How do we tag BCANs for such aggregated orders? Do we need to submit the customers’ CID?

Q2 :

We are an RRI (RRI EP1). When we receive an aggregated order from another RRI (RRI A), can we further aggregate orders from our other clients to the aggregated order received from RRI A?

In general, when RRI EP1 receives an on-exchange aggregated order from RRI A, the order is tagged with the BCAN “[CE number of RRI A].2”. RRI EP1 should pass on this order and BCAN to SEHK (either directly or via other RRIs) without any further aggregation.

In the case of an off-exchange aggregated trade, the selling/buying (depending on which side the aggregation happens) EP should normally tag the CE number of the RRI which assigned the BCANs to the Relevant Clients (i.e. the RRI which aggregated the trade) and the specific reserved BCAN “2” to the aggregated trade.

The RRI should submit the Aggregated Transaction Report to SEHK for aggregated on-exchange orders that have been executed (fully or partially) and for aggregated off-exchange trades by the time prescribed by SEHK on or before T+3 day. Please see Example 1 below.

For certain off-exchange trades which involve aggregation of trades on multiple levels of RRIs (i.e. further aggregation on an aggregated trade), it is acceptable to report such trades by adopting the alternative approaches as set out in Examples 2 and 3 below.

For the avoidance of doubt, off-exchange trades refer to trades of a listed security which take place outside SEHK’s automatic order matching system but which are reportable by EPs to SEHK pursuant to its rules.

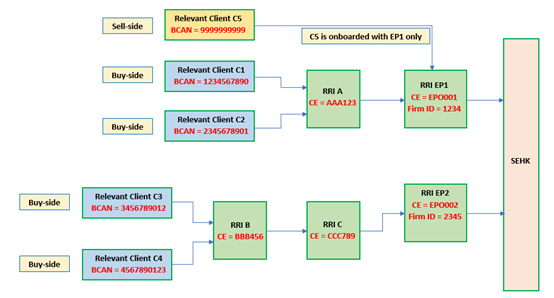

Example 1:

Transaction date (T): 20 March 2023

Two off-exchange aggregated trades are executed in which 4 clients (Clients C1, C2, C3 and C4) respectively buy 2,000 shares, 2,000 shares, 5,000 shares and 1,000 shares of a security (stock code: 8888) and a client (C5) sells 10,000 shares of the same security at price $0.246.

Reporting on 20 March 2023 (T day):

RRI EP1 to input the aggregated trade to SEHK:

|

Buy side EP |

Sell side EP |

Buy side CE No. and BCAN |

Sell side CE No. and BCAN b |

Quantity |

Stock Code |

Price |

|

RRI EP1 |

RRI EP1 |

AAA123.2 |

EPO001.9999999999 |

4,000 |

8888 |

0.246 |

RRI EP1 to input the aggregated trade to SEHK:

|

Buy side EP |

Sell side EP |

Buy side CE No. and BCAN |

Sell side CE No. and BCAN b |

Quantity |

Stock Code |

Price |

|

RRI EP2 |

RRI EP1 |

BBB456.2 a |

EPO001.9999999999 |

6,000 |

8888 |

0.246 |

Note a: RRI EP2 will tag its CE number and BCAN for the buy side of the trade within 15 minutes after RRI EP1 inputs the details of a sale transaction into the system or within 30 minutes after the conclusion of the transaction, whichever is later. Please refer to the new Rule 538A(6)(c) of SEHK’s Rules of the Exchange for details.

Note b: If there is more than one seller, the sell side of the trade can also be inputted as an aggregated trade, using the specific reserved BCAN “2”.

On or before 23 March 2023 (T+3 day), RRI A (or RRI EP1) and RRI B (or RRI EP2) to submit an Aggregated Transaction Report respectively:

RRI A (or RRI EP1) to submit:

|

A |

B |

C |

D |

E |

F |

G |

H |

I |

J |

|

Item No. |

Reporting Date |

CE No. of Reporting Regulated Intermediary |

Executing Exchange Participant Firm ID |

Transaction Date |

Stock Code |

Price |

Quantity |

Side (B/S) |

Underlying individual CE No. and BCAN c |

|

1 |

20230323 |

AAA123 |

1234 |

20230320 |

8888 |

0.246 |

2000 |

B |

AAA123.1234567890 |

|

2 |

20230323 |

AAA123 |

1234 |

20230320 |

8888 |

0.246 |

2000 |

B |

AAA123.2345678901 |

RRI B (or RRI EP2) to submit:

|

A |

B |

C |

D |

E |

F |

G |

H |

I |

J |

|

Item No. |

Reporting Date |

CE No. of Reporting Regulated Intermediary |

Executing Exchange Participant Firm ID |

Transaction Date |

Stock Code |

Price |

Quantity |

Side (B/S) |

Underlying individual CE No. and BCAN c |

|

1 |

20230323 |

BBB456 |

2345 |

20230320 |

8888 |

0.246 |

5000 |

B |

BBB456.3456789012 |

|

2 |

20230323 |

BBB456 |

2345 |

20230320 |

8888 |

0.246 |

1000 |

B |

BBB456.4567890123 |

Note c: the CE number to be inserted before the BCAN of the Relevant Client still bears the CE number of the RRI which assigns the BCAN.

**********************

However, certain off-exchange trades may involve aggregation of trades on multiple levels of RRIs (i.e. further aggregation on an aggregated trade), e.g. in an Equity Capital Market transaction or block trade. In such cases, the selling/buying EP (depending on which side the aggregation happens) may report the off-exchange aggregated trade separately as per Example 1, or adopt the following 2 alternative approaches:

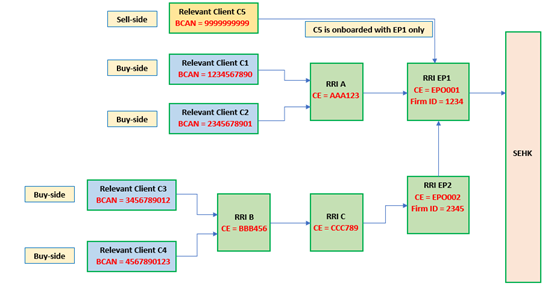

Example 2:

The selling/buying EP (depending on which side the aggregation happens) may report the total off-exchange aggregated trades for more than one RRIs in one single trade, by tagging the CE number of the EP (instead of the CE number of the RRI which assigned the BCANs to the Relevant Clients) and the specific reserved BCAN “2” to the trade on T day. The EP or the RRI which aggregates the trade should on or before T+3 day report each trade underlying the aggregated trade by submitting the Aggregated Transaction Report to SEHK. For clarification, the Aggregated Transaction Report should include the details of each underlying trade on the level of the Relevant Client, not on the RRI level (or the broker level).

Reporting on 20 March 2023 (T day):

RRI EP1 to input the aggregated trade to SEHK:

|

Buy side EP |

Sell side EP |

Buy side CE No. and BCAN |

Sell side CE No. and BCAN |

Quantity |

Stock Code |

Price |

|

RRI EP1 |

RRI EP1 |

EPO001.2 d |

EPO001.9999999999 |

10,000 |

8888 |

0.246 |

Note d: If this alternative approach is adopted for reporting aggregation of trades on multiple levels of RRIs, the EP conducting the overall aggregation and inputting this trade (i.e. RRI EP1) should fill in the “Buy BCAN” Field with its own CE number and the specific reserved BCAN “2”. It should fill in the “Quantity” Field with the total quantity of all the relevant aggregated trades on the buy side.

On or before 23 March 2023 (T+3 day), RRI A (or RRI EP1) and RRI B (or RRI EP2) to submit an Aggregated Transaction Report respectively:

RRI A (or RRI EP1) to submit:

|

A |

B |

C |

D |

E |

F |

G |

H |

I |

J |

|

Item No. |

Reporting Date |

CE No. of Reporting Regulated Intermediarye |

Executing Exchange Participant Firm ID |

Transaction Date |

Stock Code |

Price |

Quantity |

Side (B/S) |

Underlying individual CE No. and BCAN e |

|

1 |

20230323 |

EPO001 |

1234 |

20230320 |

8888 |

0.246 |

2000 |

B |

AAA123.1234567890 |

|

2 |

20230323 |

EPO001 |

1234 |

20230320 |

8888 |

0.246 |

2000 |

B |

AAA123.2345678901 |

RRI B (or RRI EP1 or RRI EP2) to submit:

|

A |

B |

C |

D |

E |

F |

G |

H |

I |

J |

|

Item No. |

Reporting Date |

CE No. of Reporting Regulated Intermediary e |

Executing Exchange Participant Firm ID |

Transaction Date |

Stock Code |

Price |

Quantity |

Side (B/S) |

Underlying individual CE No. and BCAN |

|

1 |

20230323 |

EPO001 |

1234 |

20230320 |

8888 |

0.246 |

5000 |

B |

BBB456.3456789012 |

|

2 |

20230323 |

EPO001 |

1234 |

20230320 |

8888 |

0.246 |

1000 |

B |

BBB456.4567890123 |

Note e: If this alternative approach is adopted for reporting aggregation of trades on multiple levels of RRIs, the respective RRIs/EPs should fill in Field C with the CE number of the EP who conducts the overall aggregation and inputs the trade on T day (i.e. RRI EP1) instead of the CE number of RRI A/B.

**********************

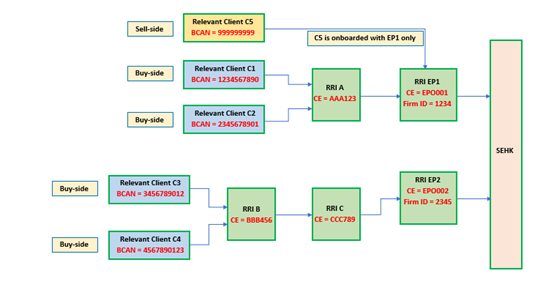

Example 3:

In certain off-exchange trades (e.g. Equity Capital Market transactions or block trades), EPs place orders based on agreed portions on T day. For example, RRI EP1 and RRI EP2 each places a buy order of 5,000 shares of a security (stock code: 8888) on behalf of their clients and client C5 is selling 10,000 shares of the same security on T day. On T+3 day, clients C1, C2, C3 and C4 are allocated 2,000 shares, 2,000 shares, 5,000 shares and 1,000 shares respectively.

Reporting on 20 March 2023 (T day):

RRI EP1 to input the aggregated trade to SEHK based on the agreed portion:

|

Buy side EP |

Sell side EP |

Buy side CE No. and BCAN |

Sell side CE No. and BCAN |

Quantity |

Stock Code |

Price |

|

RRI EP1 |

RRI EP1 |

EPO001.2 |

EPO001.9999999999 |

5,000 |

8888 |

0.246 |

RRI EP1 to input the aggregated trade to SEHK based on the agreed portion:

|

Buy side EP |

Sell side EP |

Buy side CE No. and BCAN |

Sell side CE No. and BCAN |

Quantity |

Stock Code |

Price |

|

RRI EP2 |

RRI EP1 |

EPO002.2 f |

EPO001.9999999999 |

5,000 |

8888 |

0.246 |

Note f: RRI EP2 will tag its CE number and BCAN for the buy side of the trade within 15 minutes after RRI EP1 inputs the details of a sale transaction into the system or within 30 minutes after the conclusion of the transaction, whichever is later. Please refer to the new Rule 538A(6)(c) of the SEHK’s Rules of the Exchange for details.

On or before 23 March 2023 (T+3 day), RRI EP1 and RRI EP2 to submit an Aggregated Transaction Report respectively:

RRI EP1 to submit:

|

A |

B |

C g |

D |

E |

F |

G |

H h |

I |

J |

|

Item No. |

Reporting Date |

CE No. of Reporting Regulated Intermediary |

Executing Exchange Participant Firm ID |

Transaction Date |

Stock Code |

Price |

Quantity |

Side (B/S) |

Underlying individual CE No. and BCAN |

|

1 |

20230323 |

EPO001 |

1234 |

20230320 |

8888 |

0.246 |

2000 |

B |

AAA123.1234567890 |

|

2 |

20230323 |

EPO001 |

1234 |

20230320 |

8888 |

0.246 |

2000 |

B |

AAA123.2345678901 |

|

3 |

20230323 |

EPO001 |

1234 |

20230320 |

8888 |

0.246 |

1000 |

B |

BBB456.4567890123 |

RRI EP2 to submit:

|

A |

B |

C g |

D |

E |

F |

G |

H h |

I |

J |

|

Item No. |

Reporting Date |

CE No. of Reporting Regulated Intermediary |

Executing Exchange Participant Firm ID |

Transaction Date |

Stock Code |

Price |

Quantity |

Side (B/S) |

Underlying individual CE No. and BCAN |

|

1 |

20230323 |

EPO002 |

2345 |

20230320 |

8888 |

0.246 |

5000 |

B |

BBB456.3456789012 |

Note g: Similar to Example 2, if this alternative approach is adopted, the respective EPs should fill in Field C with its own CE number instead of the CE number of RRI A/B.

Note h: The total quantity each EP reports on or before T+3 day should be the same as that it inputs as an agreed portion on T day, i.e. RRI EP1 to report total quantity of 5,000 shares and RRI EP2 to report total quantity of 5,000 shares. To ensure BCANs of all underlying clients are submitted to SEHK on or before T+3 day, RRI B in this example should pass on Client C4’s “Underlying individual CE No. and BCAN” (information in Column J) to RRI EP1 (whether via RRI EP2) for submission (please see item 3 of RRI EP1’s report).

Please note that as per paragraph 5.6(h) of the Code of Conduct, underlying BCANs can be submitted by an RRI directly or through another RRI. Nevertheless, EPs should ensure that their respective FULL execution quantity is reported on or before T+3 day.

*******************************

The alternative approaches in Examples 2 and 3 may only be adopted upon satisfaction of both of the following:

- The alternative approaches are only applicable to off-exchange trades other than those off-exchange trades which are executed on Type 7 automated trading services. In other words, off-exchange trades which are dark pool trades or alternative liquidity pool trades should be reported on a trade-by-trade basis, as per the existing practice prescribed by SEHK; and

- The alternative approaches are NOT applicable to any on-exchange orders, which, if aggregation happens in one order, should involve aggregation by one RRI only, i.e. no aggregation of orders on multiple levels of RRIs (in other words, no further aggregation on an aggregated order) for on-exchange orders. Please refer to Example 1 above.

Last update: 17 Mar 2023